Why Work with a Trustee

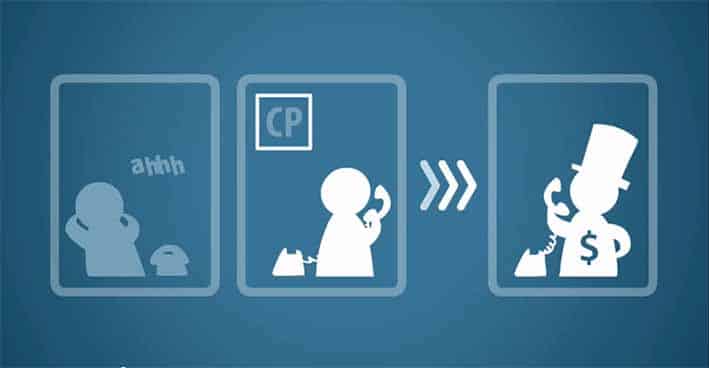

When filing for a consumer proposal, it is important that you work with a trustee (aka advisor), as only a trustee can present a consumer proposal. They will also be able to provide you with the help and advice that you cannot acquire on your own. To contact a trustee in your province or area, please visit our Contact a Trustee page. Below is the process that your licensed Trustee will guide you through when filing for a consumer proposal;

- Working with Your Trustee. You will be required to provide all essential information about your household income, debts, and assets to your trustee.

- Offer to Your Creditors. You and your trustee need to determine what you are going to offer your creditors. After which you will have to attend a meeting to sign the legal documents for filing with the government and your creditors. If by chance your proposal is not accepted, you will have to attend a meeting discussing counter offers made by your creditors. You will also not be able to file another proposal. If you want to know more about a rejected proposal, visit our What Happens if my Creditors reject my Consumer Proposal page.

- Keeping up Your Payments. Once your consumer proposal is accepted, you are obligated to keep up your payments according to the terms of your proposal, which generally requires a monthly payment. If you fall three payments behind, your trustee can annul your consumer proposal, in which your creditors can continue their collection activity.

- Attending Credit Counselling. You will need to complete two credit counselling sessions once your consumer proposal is accepted, and before you are done making payments. During these sessions you will typically discuss money management, budgeting, and the use of credit information.

- Completion. Once you have carried out the terms of your repayment and you have completed your credit counselling sessions, you will receive a compliance certificate, in which you no longer have to repay your unsecured debts!

Debts in a Consumer Proposal

Once your consumer proposal is accepted, provided that you have completed the terms of your proposal within the designated time frame, you no longer owe the balance of your debts. When your creditors accept your consumer proposal, they are agreeing to accept that amount, rather than the original amount with interest. This means that once the consumer proposal is finished, you only paid the amount that was agreed upon in your proposal. However, there are some types of debt which cannot be included in a consumer proposal, including recent student loan debts, court fines, and support payments. Please visit our What Happens to my Debts when I File a Consumer Proposal and our other pages about debts in consumer proposals for more information.

In most cases you are allowed to include government debts, such as debts to the Canada Revenue Agency (CRA). You can include government debts such as owing on your personal income tax returns, if you are behind on your business GST account, or if you have amounts owing to the Canada Mortgage and Housing Company. The CRA will review your consumer proposal as any other creditor would, giving you a fair chance to include these debts and be rid of them along with your other unsecured debts. Please visit our Can I include my tax debts in my Consumer Proposal page for more information on tax debts.

Effects of a Consumer Proposal

Generally when individuals file a consumer proposal, they have various concerns weighing on their minds. One of these concerns is how it will affect their spouse. In Canada your debt responsibility and credit scores do not fall on your spouse because you are married or common-law. It is your individual credit record that is affected by the filing of your consumer proposal. However, you need to know if your spouse is considered responsible for your credit, as well as yourself. If you want to know more, please visit our Does Filing a Consumer Proposal affect my Spouse page.

Another typical concern is what happens to the house. If your payments are up to date on your mortgage, you are able to maintain payments and keep your home. However, your home equity is a major factor in a consumer proposal. This means that if your house was to be sold, would there be money left after paying the mortgage holder and associated costs. If you had a considerable amount of equity, you would want to make a desirable offer to your creditors. For more information, visit our What Happens to my House when I File a Consumer Proposal page.

People also often wonder how their credit score will be affected within a consumer proposal. The credit bureau is notified when you file your consumer proposal, in which the information is entered on your credit report, and your credit score is updated. When your payments are complete, the administrator will issue a Certificate of Full Performance and your credit record will be updated again. The consumer proposal will stay on your credit record for three years from the date of your proposal completion. For more information, please visit our How Long does a Consumer Proposal stay on my Credit Report in Canada page.